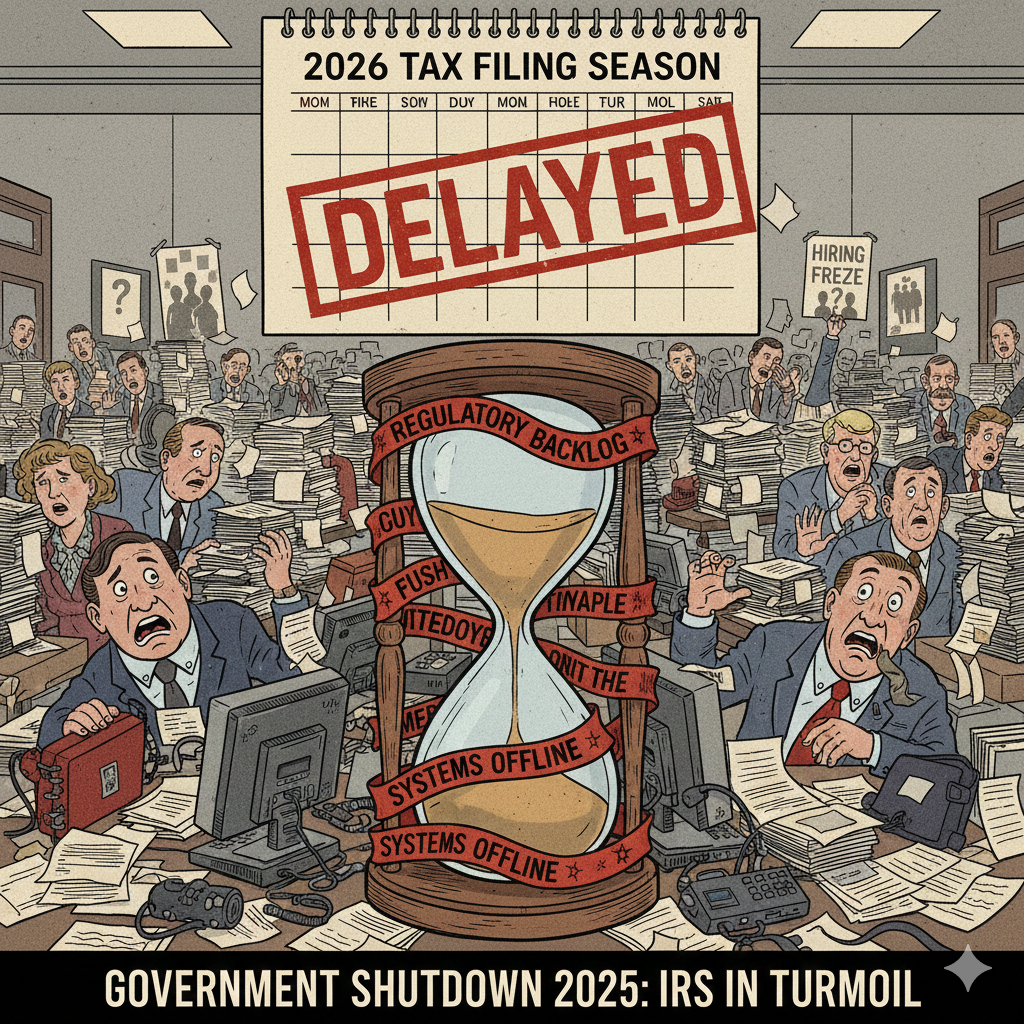

How may the 2025 government shutdown impact IRS preparation for the 2026 filing season?

Former IRS Commissioner Danny Werfel expressed concern over events since his resignation in January 2025 that he believes will have an adverse impact on IRS’ ability to handle operations for the 2026 filing season.

Those events comprise of –

- The 2025 government shutdown that just ended,

- IRS furloughs including seven different senior IRS officials,

- The passing of the One Big Beautiful Bill Act (OBBBA) in July 2025, and

- Reductions in the IRS agency’s overall workforce.

Before tax season, and around this time of year, the IRS usually updates forms, instructions and technology to reflect the number of changes that occurs in the tax code or guidance. However, according to Mr. Werfel the IRS is in uncertain chaos this year, which can stall progress and decision making.

Consequences To IRS Of The 2025 Government Shut Down

The last government shutdown was during Trump’s first term (December 22, 2018 to January 25, 2019). The most recent 2025 government shutdown lasted about 40 days. Here are some things that you should consider that makes the 2025 government shutdown different from Trump’s first term government shutdown:

- IRS does not have an IRS Commissioner leading the agency. Instead Treasury Secretary Scott Bessent is designated as the acting IRS Commissioner.

- Year-end holidays (Thanksgiving, Christmas and New Year’s Day) will be upon us.

- The time between Christmas and New Year’s Day is reserved by IRS to get their computer systems ready for next year’s filing season.

- The longer the shutdown, the greater amount of backlog in mail, faxes and voice messages that IRS officials will need to go through.

- No guarantee that all those employees who were furloughed during the shutdown will be coming back to work, thus resulting in further staffing shortages.

Considering the foregoing, it may not be until 1st quarter 2026 that IRS operations are back to a normal status and keep in mind that the current funding of the federal government is due to expire January 30, 2026 which could further challenge IRS’ ability to get to normal operations.

An Opportunity For Taxpayers Who Owe The IRS.

Do not think that if you owe the IRS your tax problem will disappear because the IRS is not fully operational. Instead you should be utilizing this valuable time to get yourself prepared so you are ready to make the best offer or proposal to take control of your outstanding tax debts.

As a prerequisite to any proposal to the IRS, you must be in current compliance. That means if you have any outstanding income tax returns, they must be completed and submitted to IRS. Also, if you are required to make estimated tax payments, you must be current in making those payments. As we are in the last quarter of 2025, taxpayers who expect to owe for 2025 should start organizing their records for 2025 so that in early 2026, their 2025 income tax returns can be completed and the 2025 liability can be rolled over into any proposal. Under such a scenario you would not be required to make estimated tax payments until 2026.

What Should You Do?

You know that at the Law Offices Of Jeffrey B. Kahn, P.C. we are always thinking of ways that our clients can save on taxes. Even if the IRS is not fully prepared for the upcoming 2026 tax season it is going to happen and you need to be ready for it, especially with the passing of OBBBA and new Treasury Department and IRS guidance. If you are selected for an audit, stand up to the IRS by getting representation. Tax problems are usually a serious matter and must be handled appropriately so it’s important to that you’ve hired the best lawyer for your particular situation. The tax attorneys at the Law Offices Of Jeffrey B. Kahn, P.C. located in Orange County (Irvine), Los Angeles and elsewhere in California are highly skilled in handling tax matters and can effectively represent at all levels with the IRS and State Tax Agencies including criminal tax investigations and attempted prosecutions, undisclosed foreign bank accounts and other foreign assets, and unreported foreign income. Also if you are involved in cannabis, check out what our cannabis tax attorneys can do for you. And if you are involved in cryptocurrency, check out what a bitcoin tax attorney can do for you.

Follow

Follow Follow

Follow