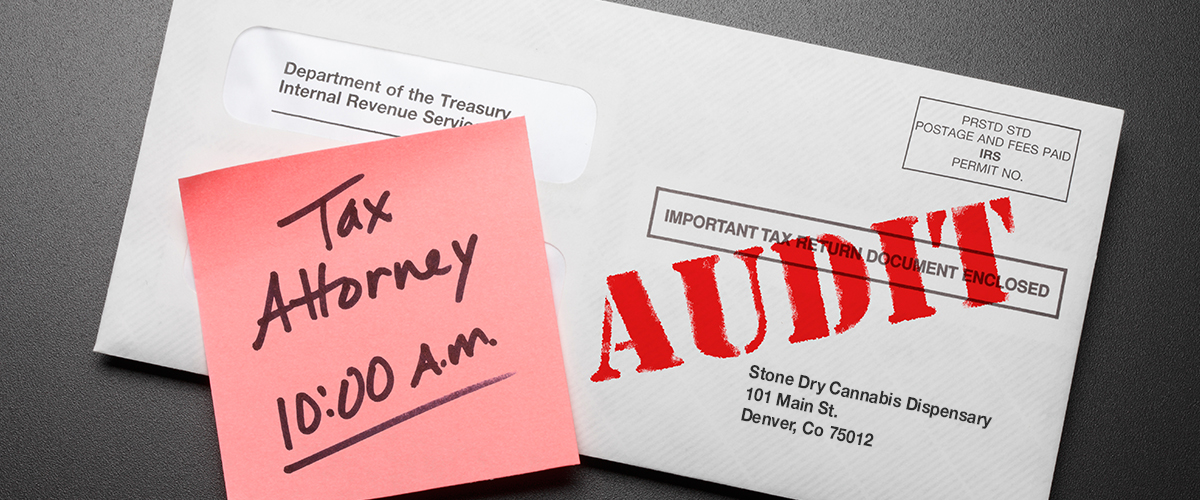

Why Hire A Tax Attorney If You Are In U.S. Tax Court?

Why Hire A Tax Attorney If You Are In U.S. Tax Court?

If you are dealing with a tax liability issue with the IRS and you are unable to reach a satisfactory resolution working with the IRS directly, then you may need to seek relief in the United States Tax Court. The U.S. Tax Court has jurisdiction over matters involving individual and business tax liability under the Internal Revenue Code, and, while individual taxpayers have the option to appear before the court pro se, most Tax Court litigants will benefit greatly from hiring a Board Certified Tax Attorney to represent them.

What Is The United States Tax Court?

The United States Tax Court is a Federal trial court. Because it is a court of record, a record is made of all its proceedings. It is an independent judicial forum. It is not controlled by or connected with the IRS. Congress pursuant to its authority under Article 3 of the U.S. Constitution created the Tax Court as an independent judicial authority for taxpayers disputing certain IRS determinations. The Tax Court’s authority to resolve these disputes is called its jurisdiction. Generally, a taxpayer may file a petition in the Tax Court in response to certain IRS determinations. A taxpayer who begins such a proceeding is known as the “petitioner”, and the Commissioner of Internal Revenue is the “respondent”.

Although the Tax Court is headquartered in Washington, D.C., its judges preside at trials in 60 U.S. cities, and its Special Trial Judges preside at trials in those cities and 15 additional cities.

How Do You Start A Case In The U.S. Tax Court?

If a taxpayer and the IRS do not agree to the findings of a tax examination, the IRS will send a notice proposing a tax adjustment (known as a “statutory notice of deficiency”). The statutory notice of deficiency gives you as the taxpayer the right to challenge the proposed adjustment in the U.S. Tax Court before paying it. To do this, you need to file a petition within 90 days of the date of the notice (150 days if the notice is addressed to you outside the United States). If you filed your petition on time, the Tax Court will eventually schedule your case for trial at the designation place of trial you set forth in your petition. Prior to trial you should have the opportunity to seek a settlement with IRS Area Counsel and in certain cases, such settlement negotiations could be delegated to the IRS Office Of Appeals.

If there is still disagreement and the case does go to trial, you will have the opportunity to present your case before a Tax Court judge. The judge after hearing your case and reviewing the record and any post-trial briefs will render a decision in the form of an Opinion. It could take as much as two years after trial before an Opinion issued. If the Opinion is not appealed to a Circuit Court Of Appeals, then the proposed deficiency under the Opinion is final and your account will be sent to IRS Collections.

IRS Area Counsel are experienced trial attorneys working for the IRS whose job is to litigate cases in the U.S. Tax Court and look out for the best interests of the Federal government. Therefore, to level the playing field, it would be prudent for a taxpayer to hire qualified tax counsel as soon as possible to seek a mutually acceptable resolution without the need for trial, and if that does not happen, to already have the legal expertise in place to vigorously defend you at trial.

Reasons To Hire A Board Certified Tax Attorney

For a professional to be good at what he/she does, training and experience are necessary. The more real work experience you get, the more skilled you will be at your job. Most people do not have the adequate legal and tax knowledge to attend hearings or go to U.S. Tax Court without a Board Certified Tax Attorney present. Here are some other benefits of working with one.

Peace of mind

Although you can represent yourself in U.S. Tax Court, you may end up regretting it, especially if the outcome is not good. Having a Board Certified Tax Attorney with you will give you peace of mind irrespective of the case you are faced with. You can be confident that your case is being handled by someone who understands your legal and tax problems better and they will handle your case with utmost professionalism. Additionally, resolving complex tax issues requires much more than simply finding the relevant provisions of the Internal Revenue Code. A Board Certified Tax Attorney will be able to conduct the necessary legal research to build a convincing (and legally-sound) argument for the best possible result.

Avoid incriminating yourself

Seasoned tax attorneys will spend time coaching their clients on how to behave and speak while in the U.S. Tax Court. This is important because the behavior and candor of a taxpayer in the courtroom can have tremendous effects on the case. A Board Certified Tax Attorney will go out of his/her way to ensure that you do not incriminate yourself whenever you speak in the Tax Court.

Reduce risks

Getting representation from a Board Certified Tax Attorney will boost the chances of keep your case on track to reaching the best possible result. A Board Certified Tax Attorney has experience handling tax cases in the U.S. Tax Court and they will handle any emerging issues before they become major problems for your case. When things get tough, you will be sure that your tax lawyer has the expertise and specialized training to handle the problem.

Conversant with all court procedures and rules

After filing a petition in the U.S. Tax Court, there are various time, form, and other procedural requirements that apply. An attorney who regularly practices before the Tax Court will be intimately familiar with these issues and will be able to ensure that procedural miscues do not jeopardize your case. Adhering to these procedures is crucial to the outcome of your case.

During your U.S. Tax Court case, the IRS through its counsel may file various motions to try to resolve the case with a finding of liability prior to trial. A Board Certified Tax Attorney will be able to interpret the substantive and strategic intent behind these motions and file appropriate responses with the Tax Court.

In many cases, issues that require resolution in the U.S. Tax Court will have ancillary legal implications as well. A Board Certified Tax Attorney will be able to identify these issues and address them before they lead to unnecessary costs and exposure.

Save you money

Given the costly legal fees that people pay, it is difficult to believe that a Board Certified Tax Attorney can help you save cash. Most cases filed with the U.S. Tax Court settle. Should you settle your case? If so, when? A Board Certified Tax Attorney will be able to rely on the insights gained from numerous prior U.S. Tax Court cases to help you make informed decisions regarding settling or taking your case to trial.

What Should You Do?

When faced with litigation in the U.S. Tax Court, you need a tax lawyer by your side. Level the playing field and gain the upper hand by engaging a tax attorney at the Law Offices Of Jeffrey B. Kahn, P.C. located in Orange County (Irvine), Los Angeles and other California locations. We can come up with solutions and strategies to these risks and protect you and your business to maximize your net profits. Additionally, if you are involved in cannabis, check out what a cannabis tax attorney can do for you. And if you are involved in crypto currency, check out what a bitcoin tax attorney can do for you.

Follow

Follow Follow

Follow